Alternative Investments

Diversifying with Alternative Investments

Alternatives can help diversify and complement traditional portfolios by seeking returns that are independent from equity and bond markets and reducing overall sensitivity to traditional markets.

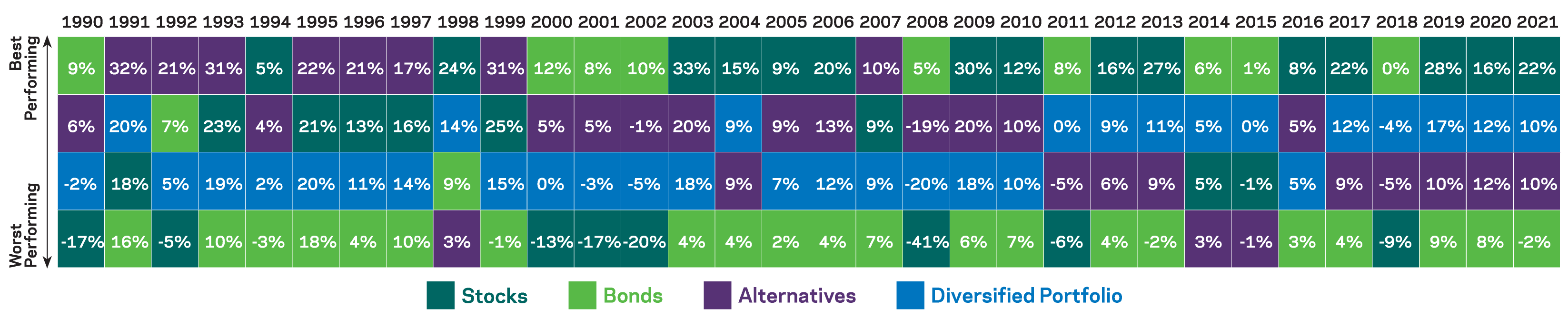

It is difficult to predict when investments will perform well or poorly over the next decade or even the next year. As shown in the chart below, Stocks, Bonds, and Alternatives have each experienced performance highs and lows over time. However, the Diversified Portfolio, which incorporates and spreads risk across all three asset classes, has experienced more consistent long-term performance. As a diversifying asset class, alternatives can be viewed as a valuable component of a long-term investment plan.

Why Invest in Alternatives?

In this video introduction, we outline the potential benefits of investing in alternatives and explain how they may enhance a traditional portfolio.

Risk Disclosures:

Alternative investing strategies such as Equity Market Neutral and Managed Futures involve the use of derivatives, forward and futures contracts, and commodities, which can lead to additional risks including increased volatility, lack of liquidity, and possible losses greater than the initial investment as well as increased transaction costs. All investors considering these strategies should be able to tolerate wide price fluctuations. Arbitrage strategies have the risk that the anticipated opportunities do not play out as planned, resulting in potentially reduced returns or losses. Before trading, investors should carefully consider their financial position and risk tolerance to determine if the proposed trading style is appropriate. All investing is subject to risk including the loss of principal. All funds committed to such a trading strategy should be purely risk capital. Past performance is no guarantee of future results. Diversification does not eliminate risk.

An alternative allocation can be an effective strategy against uncertainty and the inevitable underperformance of an individual asset class.

Calendar Year Performance

January 1, 1990 - December 31, 2019

AQR: A Leader in Alternatives

As a leader in alternatives, AQR has more than 20 years of experience managing the complexities of these strategies, including ten years of managing alternative mutual funds. We encourage you to explore our research on alternative investing on aqr.com.