Style Investing

Understanding Style Investing

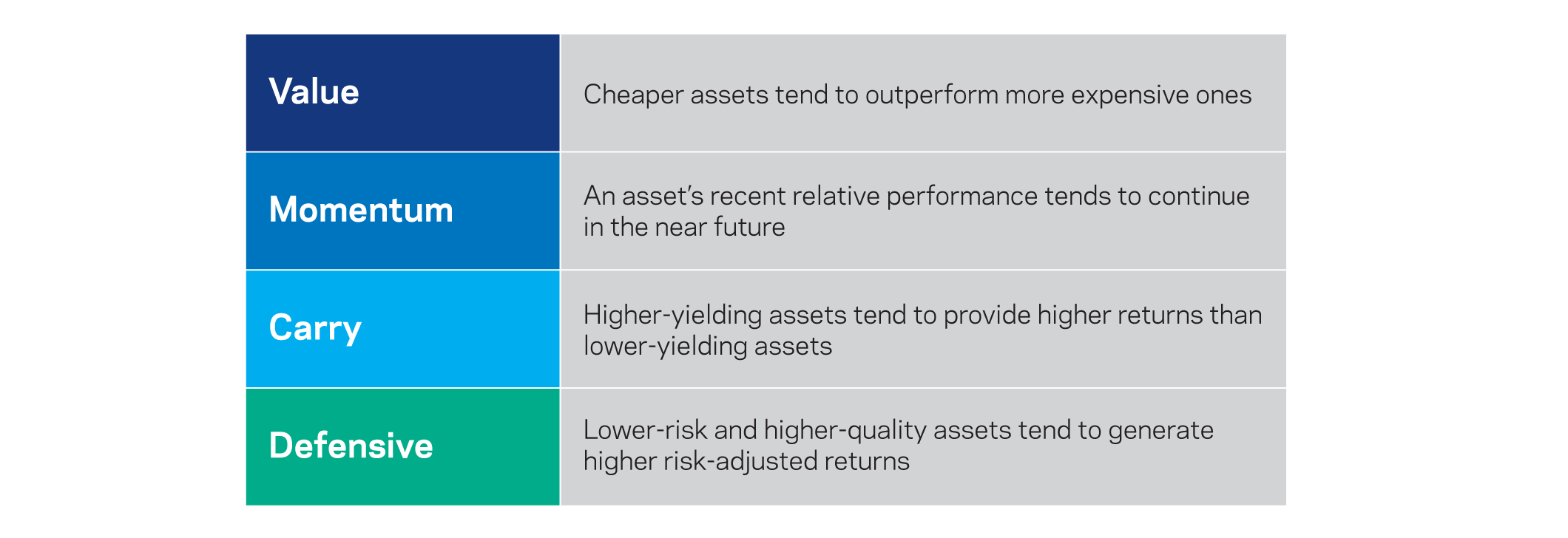

Style investing uses a disciplined, systematic process to identify securities for a portfolio based on consistent and repeatable drivers of return. These are called styles, factors or themes, and are grounded in empirical evidence and economic intuition. Some of the most well-known styles are Value, Momentum, Carry, and Defensive. These, among many others, form the building blocks of AQR’s systematic approach to investing.

How does it work?

Each of these four styles identifies a specific set of characteristics in the securities of an asset class that help distinguish winners from losers.

Systematic Equity Investing

Our research shows that combining multiple pervasive styles in one portfolio, implemented across a broad investment universe including multiple asset classes and countries, can provide distinct portfolio benefits over time.